The questions and answers below pertain to round 1 of our stabilization funding, which wound down in 2021. We’re keeping it up for reference.

For up to date information about our stabilization funding — including the round 2 distribution in 2022 — see our main child care stabilization page and current stabilization funding FAQ.

What is Child Care Program Stabilization Funding?

The federal American Rescue Plan Act (ARPA) allocated funds to Connecticut to support the operations of child care programs and businesses to help stabilize the field. OEC is distributing these funds to all licensed and license-exempt DCEX programs through an application process.

Who is eligible?

Which programs are eligible for Child Care Program Stabilization Funding?

Eligible programs must be:

- A licensed family child care home (DCFH), group home (DCGH), center (DCCC), or license-exempt center-based or school-based program eligible to receive C4K benefits (DCEX); and

- Currently open — or those that can verify that they will be reopening and serving children (children will be in attendance) within 30 days of submission of your application.

Is there an application in Spanish?

There is not a separate application in Spanish. However, you can access snapshots of the family child care application translated into Spanish to assist with completion of the application.

If I am a family child care provider and I do not currently have children enrolled, am I eligible to apply for the Child Care Program Stabilization Funding?

Yes, but you must open and be serving children within 30 days of submission of your application. If you need assistance on efforts to help increase enrollment, you can call the Women’s Business Development Council at 203-751-9550 x113 or childcarebusiness@ctwbdc.org.

Are programs that are faith-based tax-exempt eligible to apply for these funds?

Yes — as long as the program is a licensed child care center (DCCC), group child care home (DCGH), or license-exempt program eligible to receive C4K benefits (DCEX).

What is the definition of license-exempt DCEX?

License-exempt DCEX programs are child care programs that meet the following 2 criteria:

- The program falls within the licensing exemptions as outlined in section 19a-77(b) of the Connecticut General Statutes and is therefore not required to obtain a child care license

- The program is actively serving children who receive Care 4 Kids subsidy and has completed a health and safety inspection by the Office of Early Childhood’s Licensing Division

Is a local board of education that operates a license-exempt School Readiness program but does not accept Care 4 Kids funding eligible for Child Care Program Stabilization Funding?

No. Only licensed and DCEX license-exempt programs are eligible.

Can I apply if I have a pending application for a CT child care license?

You must be fully licensed by May 1, 2021 to be eligible for Child Care Program Stabilization Funding.

Can a program apply for Child Care Program Stabilization Funding if they have an open case in any legal and/or enforcement actions?

Yes.

Are there any program revenue guidelines to receive this stabilization funding?

No, there are no program revenue guidelines to receive Child Care Program Stabilization Funding. All eligible programs will receive funding, regardless of the sources of income to the program.

Am I eligible to apply for Child Care Program Stabilization Funding if my program is currently closed?

Yes. Closed programs will be able to receive stabilization funding if they are open and serve children within 30 days of submission of your application. If your program was open for and operates for the school-year only and is closed for the summer, your program is still eligible.

The eligibility requirement says my program has to be open or “verified reopening.” What does that mean?

The Child Care Program Stabilization Funding is intended to help your program open and provide care for children. Programs should let their OEC licensing specialist and 2-1-1 Child Careknow they are open by calling 1-800-505-1000 or completing the status survey here. A program may apply for Child Care Program Stabilization Funding if they attest that they are planning to reopen within 30 days of receipt of your application. The program should have all the necessary confirmations to reopen and have staffing, child enrollment, and supplies ready.

What if I attest to the verified reopening but my program does not reopen?

If you attest to the verified reopening of the program but do not reopen, you must return the funds. The only exception to this is if your program operates school year only and you intend to fully re-open at the beginning of the 2021 school year.

If my program is a school-year only program and we are closed for the summer, can we still apply?

Yes, as long as your program is re-opening at the beginning of the 2021 school year.

Is there a limit to the number of programs that will be funded?

No. Funds are in place for every eligible program. This is not a first-come first-served process.

How do I know if I am a part-time or full-time program?

For purposes of the Child Care Program Stabilization Funding, the definitions of full-time and part-time are as follows:

- Full-time for centers (DCCC), group homes (DCGH and license-exempt (DCEX) programs means that 50% or more of the classrooms in your program operate 30 hours or more per week.

- Full-time for family child care homes means that your program operates 30 hours or more per week.

- Part-time for centers (DCCC), group homes (DCGH) and license-exempt (DCEX) programs means that less than 50% of the classrooms in your program operate 30 hours or more per week.

- Part-time for family child care homes means that your program is open less than 30 hours per week.

How do I apply?

How does a program apply for Child Care Program Stabilization Funding?

Your program must have a State Supplier ID to receive an application. If you are eligible and already have a State Supplier ID, 2-1-1 Child Care will automatically email you an application the week of May 10, 2021. You must complete a separate application for each license. Applications are not accessible online, but snap shots of the center-based application and the family child care application (Spanish) are available.

We are a multi-site organization. Do we apply as one organization or for each site?

Each individual site will receive an email inviting an application. Please do not share the email invitation. Each site should complete its own application. The funding amount is determined based on how the criteria applies to each site.

What do I do if my program did not get an application through email?

If you believe your program is eligible and did not receive an application, please call 2-1-1 Child Care at 1-800-505-1000 or email childcarefunding@ctunitedway.org

Be sure to include your license number or licensed-exempt number to expedite assistance.(The process of obtaining a Supplier ID could take up to 4 weeks — or more if any of the information provided is incorrect.)

How do I get a State Supplier ID if I do not have one?

If you do not have a State Supplier ID — or you’re not sure if you have one — call 2-1-1 Child Care at 1-800-505-1000 or email childcarefunding@ctunitedway.org. Be sure to include your license number or licensed-exempt number to expedite assistance. You will need an IRS W-9 form to establish your State Supplier ID.

What if I don’t know my federal tax classification for the IRS W-9 Form?

If you’re not sure what kind of business you have, the IRS has additional information about filling out your W-9 form. You can also call the Women’s Business Development Council at 203-751-9550 x113 or childcarebusiness@ctwbdc.org.

If my program has received other OEC grants or contracts, does that mean we already have a State Supplier ID and don’t have to do anything additional?

Yes, you already have a State Supplier ID if you have been paid by the OEC through programs such as School Readiness, Child Day Care, CT CARES (for Child Care, for Child Care Businesses — Expense Kickstart and/or Supply Subsidy). However, you must apply for this funding opportunity once the application has been emailed to your program.

What is the application deadline for Child Care Program Stabilization Funding?

Applications for Child Care Program Stabilization Funding will be accepted through September 30, 2021.

What terms will I need to agree to to receive for the Child Care Program Stabilization Funding?

Terms and Conditions for Child Care Program Stabilization Funding – English

What is the funding equation and formula?

How much will the program receive for the Child Care Program Stabilization Funding?

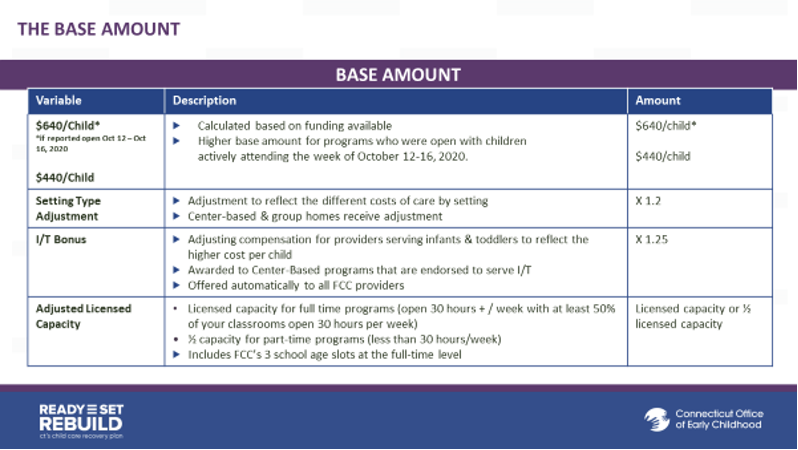

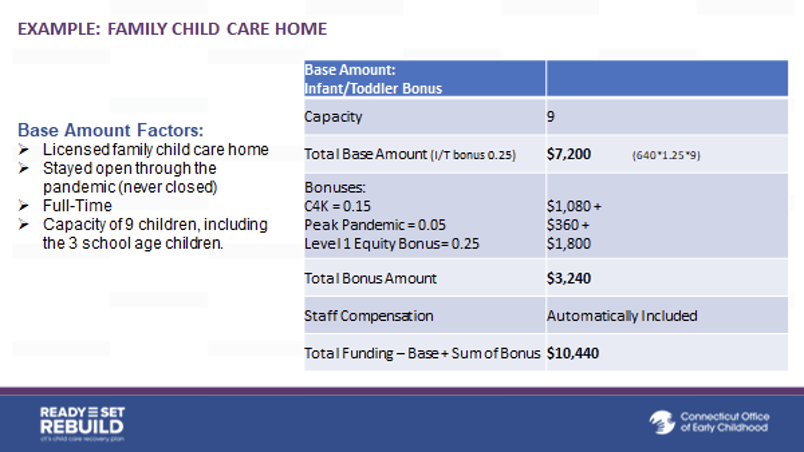

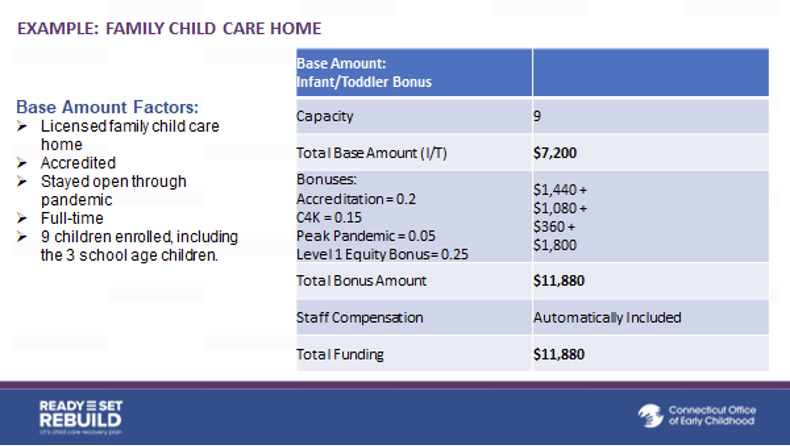

All eligible programs will receive funding if they complete the application. Each program will receive an amount determined by a formula based on your program’s data that is validated by the OEC or 2-1-1 Child Care. The funding formula provides up to a maximum payment of $500,000 per site.

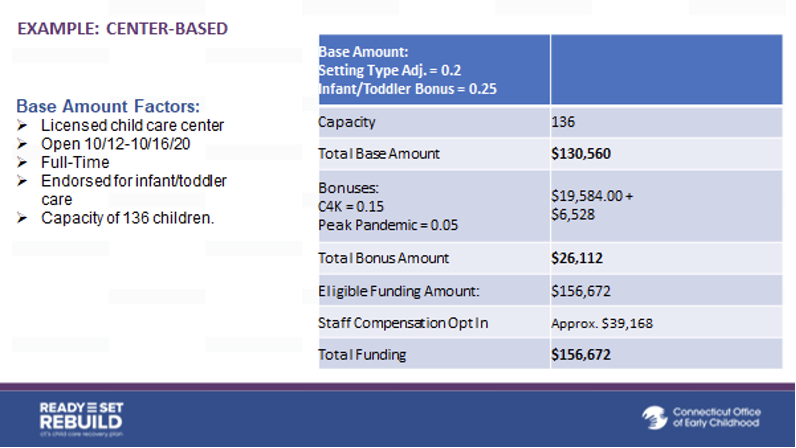

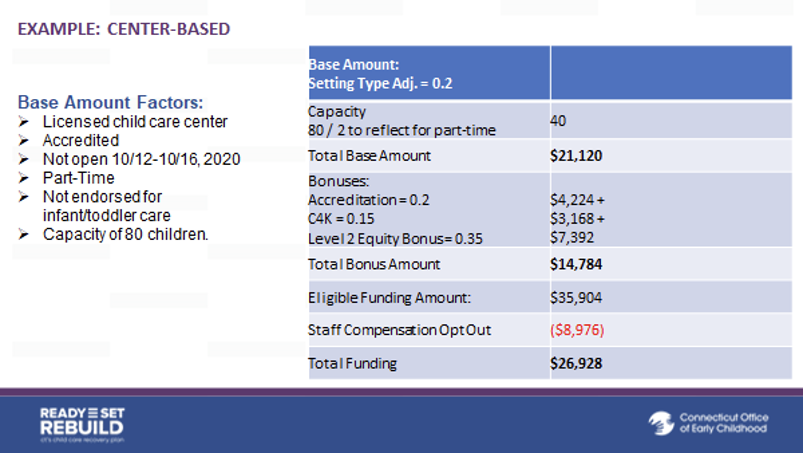

The chart below outlines the funding formula and examples:

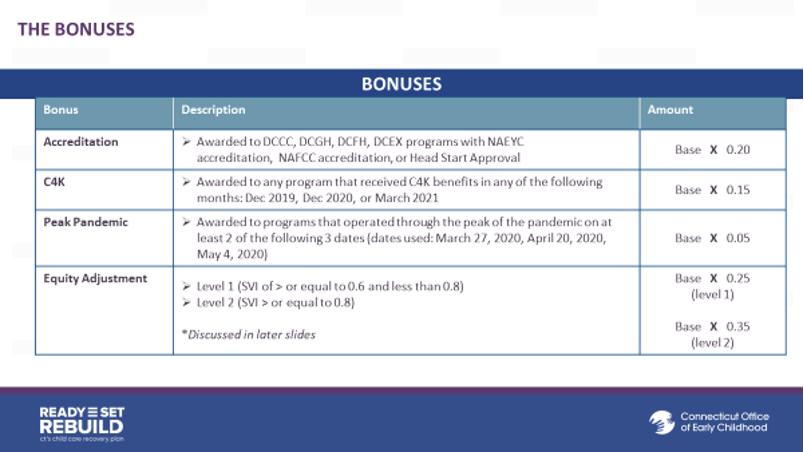

Will the OEC be looking at “equity” as a way to help stabilize programs?

Yes. OEC is providing additional funding to programs operating in under resourced communities. These programs will receive an equity bonus based on their base funding amount. The bonus will be calculated using the Social Vulnerability Index (SVI) score for the program’s facility location.

What is an SVI?

The SVI was developed by the Centers for Disease Control and Prevention (CDC) to help local officials identify communities that may need support before, during, or after a disaster. Scores are assigned at the census tract level (based on a program’s location) and take into account 15 Census variables. SVI scores range from 0 to 1 (1 being the most under-resourced areas) and are scaled relative to other census tracts in CT.

Why use an SVI for child care programs?

Programs located in areas with a high SVI are likely to serve children and families with additional systemic barriers to success. SVI is highly correlated with the percentage non-white population within a census tract, supporting OEC’s racial equity goals. SVI is used by other state agencies and enables OEC to get funds out quickly.

How will the OEC use SVI to determine Equity Bonuses?

SVI values are associated with census tracts. Census tracts are determined by the U.S. Census Bureau. OEC matched program’s facility addresses with their census tracts to determine their SVI. As noted above, an SVI value ranges from 0 to 1. Values closer to 1 indicate greater need for support during the recovery period. OEC assigned two tiers of bonuses based on SVI. For programs whose SVI falls between 0.6 and 0.8, OEC adds 25% on to the payment. For programs with greater than 0.80, OEC adds 35% to the payment. To locate your program and understand whether your program receives an SVI bonus, search using this tool. If you have further questions about OEC’s use of SVI data, please contact us via email at childcarefunding@ctunitedway.org

Is the Child Care Program Stabilization Funding based on licensed capacity or enrollment?

OEC will pay a program based on an estimate of operating expenses and their licensed capacity. The licensed capacity listed on the OEC license is the maximum number of children your program can have present at one time. Programs that operate less than 30 hours per week will be funded at half the licensed capacity.

What if a program serves more children than our licensed capacity?

If a family care home serves more children than the licensed capacity because child care services are offered during extended business daytime hours, nights, and weekends, you will receive a separate payment at a later date for caring for children in excess of your licensed capacity. If you believe that you serve more than your licensed capacity given your attendance choices, there is a check box on the application. If you select that checkbox, there will be a verification process to complete.

How do I know if I am eligible to have the infant and toddler adjustment added into my base amount?

- The infant and toddler adjustment is automatically offered to all family child care providers

- The infant and toddler adjustment is awarded to center-based and group home programs that are licensed to serve infants and toddlers (children under the age of 3).

What does “adjusted licensed capacity” mean?

You will be funded for 100% of your licensed capacity if 50% or more of the classrooms in your program are operating 30 hours or more per week.

You will be funded for 50% of your licensed capacity if less than 50% of the classrooms in your program are operating 30 hours or more per week

What happens if less than 50% of my program’s classrooms operate 30 hours or more per week?

Your program is considered to be “part time” if 50% of your program’s classrooms operate less than 30 hours per week. To properly calculate your child care stabilization funding, your capacity will be divided in half. For examples, if your capacity is 50 children and 50% of your program’s classrooms operate less than 30 hours per week, your payments will be based on 25.

Will a program that was open during the peak of the COVID-19 pandemic receive any additional Child Care Program Stabilization Funding?

Yes. The Child Care Program Stabilization Funding formula will include a higher starting rate for programs who were open with children actively attending the week of October 12-16, 2020. This will be verified using a report generated by 2-1-1 Child Care based on responses you provided to the open/close status survey.

How was the specific week of October 12-16, 2020 selected?

This week, halfway through the year of the pandemic, was selected to represent the point at which most programs were open or reopened following the early challenges of operating under the state of emergency.

Will the Child Care Program Stabilization Funding take into account both full-time and part-time child care services?

Yes. The funding formula takes into account both full-time and part-time children. See below for definitions of full-time and part-time.

What if our program does not agree with the calculation of the Child Care Program Stabilization Funding?

On your application, there will be a check box indicating your agreement with the status of your program .as shown in one or more of the categories that will increase the total amount of funds you receive. If your program believes that the statuses were not applied correctly, you may request a review. First click on the check box indicating “I DO NOT agree with the status of my program as shown in one or more of the categories above” and then click on the “please report your concerns here” link and submit the review form. You should not submit your application until your review is complete.

How will I get paid?

How will the Child Care Program Stabilization Funding be paid to a program?

A program may apply to receive the Child Care Program Stabilization Funding by direct deposit to the program’s business account through the Office of the State Comptroller. If you choose not to receive by direct deposit, a paper check will be mailed to the address provided on the application. It is important for the program to keep records for tax filing and other purposes. Learn more about setting up direct deposit with the Office of the State Comptroller.

What documentation should be kept for auditing and/or tax purposes and for how long?

Supporting documentation must be retained for a period of 3 years and promptly submitted to OEC upon request. Supporting documentation may include:

- Program records and supporting documentation related to this application

- Documentation to verify attendance of children and/or hours of care provided outside of business hours

- Expenditure records and supporting documentation related to costs incurred and how program funding was spent, including but not limited to:

- Mortgage/rent/space cost statements

- Utility statements

- Payroll and benefits records

- Original invoices and/or receipts for purchases of materials/supplies

- Documentation of other benefits provided to child care staff members such as coverage of insurance costs or tuition reimbursement.

Will the Child Care Program Stabilization Funding be issued in one payment or multiple payments?

The program’s business office will receive 3 separate payments each separated by a 6-week interval. If your program opts in for staff compensation, the staff compensation portion will be made in a fourth payment.

We are a multi-site program — will we receive payment in one pay or by site?

If the payment will be issued by check, one check may be cut for all sites, however, it will be broken down by license number in the memo section of the check. If being paid by direct deposit, one deposit may be made into the account and a spreadsheet will be emailed to the address on file separating out the amount of payment per license number.

Is the Child Care Program Stabilization Funding taxable?

Yes, if you are a for-profit organization this funding is taxable. If you are a non-profit or not-for-profit organization, this funding is tax exempt. All organizations receiving funding must report this as income to your program. As with all funding, child care providers are responsible for tracking how funds were used. This includes being sure funds from different sources/opportunities do not pay for the same things. If you need support you can call the Women’s Business Development Council at 203-751-9550 x113 or childcarebusiness@ctwbdc.org.

Is this a loan that needs to be paid back?

This is not a loan. These funds are provided to stabilize the continued operations of the program and to cover business expenses in response to COVID-19. However, you must report this as income to your program and pay taxes on it.

How quickly does a program need to spend the Child Care Program Stabilization Funding?

A program should deposit the check(s) as soon as they are received. All funds must be spent by September, 2023 whether they are received through direct deposit or check.

What if my program closes after I have received the stabilization funding?

If your program closes, you must return any unspent funds. In order to accept the funds, the program should be serving children or have all the necessary confirmations to reopen, and serve children within 30 days of submission of your application. This plan supports the business in staying open. When a program closes they must notify the OEC’s Division of Child Care Licensing to close the license.

What can the funding be used for?

What are the allowable uses of the Child Care Program Stabilization Funding?

The funds are to help your program remain open by supporting operating and business expenses. Programs must keep records of how they have spent the funds. Funds cannot be used for personal expenses.

Child care providers may use these funds for the following purposes, including for reimbursement of expenses incurred from January, 2020 through September, 2023:

- Personnel costs, including payroll and salaries or similar compensation for an employee (including any sole proprietor or independent contractor), and benefits

- Premium pay, or costs for employee recruitment and retention, including but not limited to staff bonuses, wage increases, costs of insurance coverage, retirement, educational advancement, tuition reimbursement and child care costs

- Rent (including under a lease agreement) or payment on any mortgage obligation, utilities, or insurance

- Facility maintenance or improvements, including outdoor learning spaces/playgrounds

- Personal protective equipment, cleaning and sanitization supplies and services, or training and professional development related to health and safety practices

- Purchases of or updates to equipment and supplies to respond to COVID–19

- Goods and services necessary to maintain or resume child care services

- Mental health supports for children and employees

- Health and safety trainings for staff, including but not limited to CPR, First Aid, and medication administration

What documentation will the program need to provide regarding the use of the Child Care Stabilization Funds?

All receipts of payments towards business expenses should be retained for your records and for auditing purposes.

What are the workforce compensation requirements?

What does it mean for programs to “opt in” to Child Care Program Stabilization Funding for staff compensation?

By opting in to receive additional funds to provide staff compensation, your child care program is agreeing to use at least this additional amount of 25% of funds to provide staff compensation. The funds must be used to increase staff’s regular compensation. Consideration should be given to how to support all staff in the program. The use of these funds will be subject to audit and any improper use of funds will require repayment. Some programs may choose to use a larger portion of the child care program stabilization funding received for these purposes. However, any program that opts in to receive the staff compensation funds must use at least those funds for staff compensation purposes; these may include;

- Bonuses or increases in wages for any period between January 2020 and September 2023

- Contributions towards health insurance costs that reduce such costs for staff

- Contributions to staff retirement plans

- Educational advancement or tuition reimbursement for staff

- Coverage of child care costs for staff members’ children

If your program opts in for staff compensation, the staff compensation portion will be made in a separate, fourth payment. If you chose to opt out, your total funding will be reduced by 25%.

Whether your program opts in is up to you. Just remember that your total funding amount will be higher if you opt in and agree to spend it on compensating your staff.

Does a program have to opt in to the Child Care Program Stabilization Funding staff compensation?

No. The program is not required to opt in to the Child Care Program Stabilization Funding staff compensation. However, 25% of the funding total is contingent upon agreeing to use funds for staff compensation. The program will not receive the maximum amount of funding possible and forfeits that remaining 25%.

If a program chooses to opt out of the Child Care Program Stabilization Funding staff compensation initially, can the application be changed to opt in at a later date?

No. The program must opt in at the time of application. Program representatives should review these FAQs prior to completing and submitting their application.

Contact 2-1-1 Child Care at 1-800-505-1000 or email childcarefunding@ctunitedway.org. Make sure to have to mention or include your child care license number to speed up the process.